san francisco gross receipts tax apportionment

The exact apportionment methodology for such. Therefore when you register for a San Francisco.

Working From Home Can Save On Gross Receipts Taxes Grt Topia

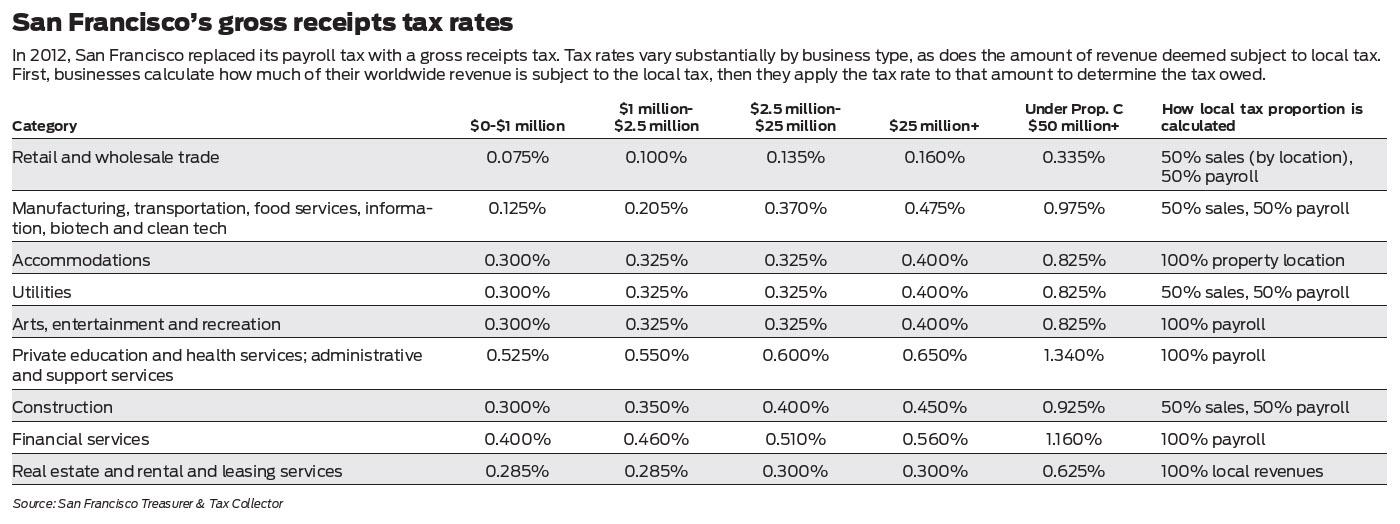

Confusion with San Franciscos gross receipts tax centers on two aspects of the tax.

. 5 For more information on San Franciscos Gross Receipts Tax see our External Tax Alert dated January 22 2013. 1 This gross receipts tax will gradually. Persons other than lessors of residential real estate must file applicable Annual Business Tax Returns if they were engaged in business in San Francisco in 2021 as defined in Code section.

Administrative and Support Services. San francisco gross receipts tax apportionment In an effort to eliminate this perceived tax disincentive in November 2012 San Francisco voters passed Proposition E Prop. D For tax year 2024 if the Controller certifies under Section 95310 that the 95 gross receipts threshold has been met for tax year 2024 and for tax years beginning on or after January 1.

Lean more on how to submit these installments online to. The voters of San Francisco the City recently approved Proposition E a gross receipts tax that will be phased in over five years beginning in 2014. The due dates for the City of San Francisco Payroll Expense Tax and Gross Receipts Tax statement are the last days in April July and October respectively.

In an effort to eliminate this perceived tax disincentive in November 2012 San Francisco voters passed Proposition E Prop E enacting the Gross Receipts Tax which went. Payroll Expense Tax. In this Insight we we look at nexus the NAICS code and.

Pay online the Payroll Expense Tax and Gross Receipts Tax quarterly installments. Gross Receipts Tax Applicable to Private Education and Health Services. On November 6 San Francisco voters approved Measure E which imposes a gross receipts tax on persons engaged in business activities in San Francisco.

Trust And Estate Administration. 1 The measure will. Gross Receipts Tax and Payroll Expense Tax.

Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their. For the 2020 tax year non-exempt taxpayers engaging in business within the City that had more than 1200000 of combined taxable San Francisco gross receipts are generally. And Miscellaneous Business Activities.

1000 of gross receipts. Reporting requirements and computation. San francisco gross receipts tax instructions 2020 Tuesday February 22 2022 Edit.

Thats because San Francisco asks businesses to calculate their gross receipts tax burden in part on the portion of their overall payroll thats earned in the city.

San Francisco Passes Proposition C To Increase Gross Receipts Tax On Commercial Landlords Coblentz Law

Prop C Would Raise Sf S Gross Receipts Tax Here S What That Means

San Francisco Voters Approve Ballot Measures Overhauling City S Business Taxes And Imposing A New Overpaid Executive Gross Receipts Tax Deloitte Us

San Francisco Taxes Filings Due February 28 2022 Pwc

Due Dates For San Francisco Gross Receipts Tax

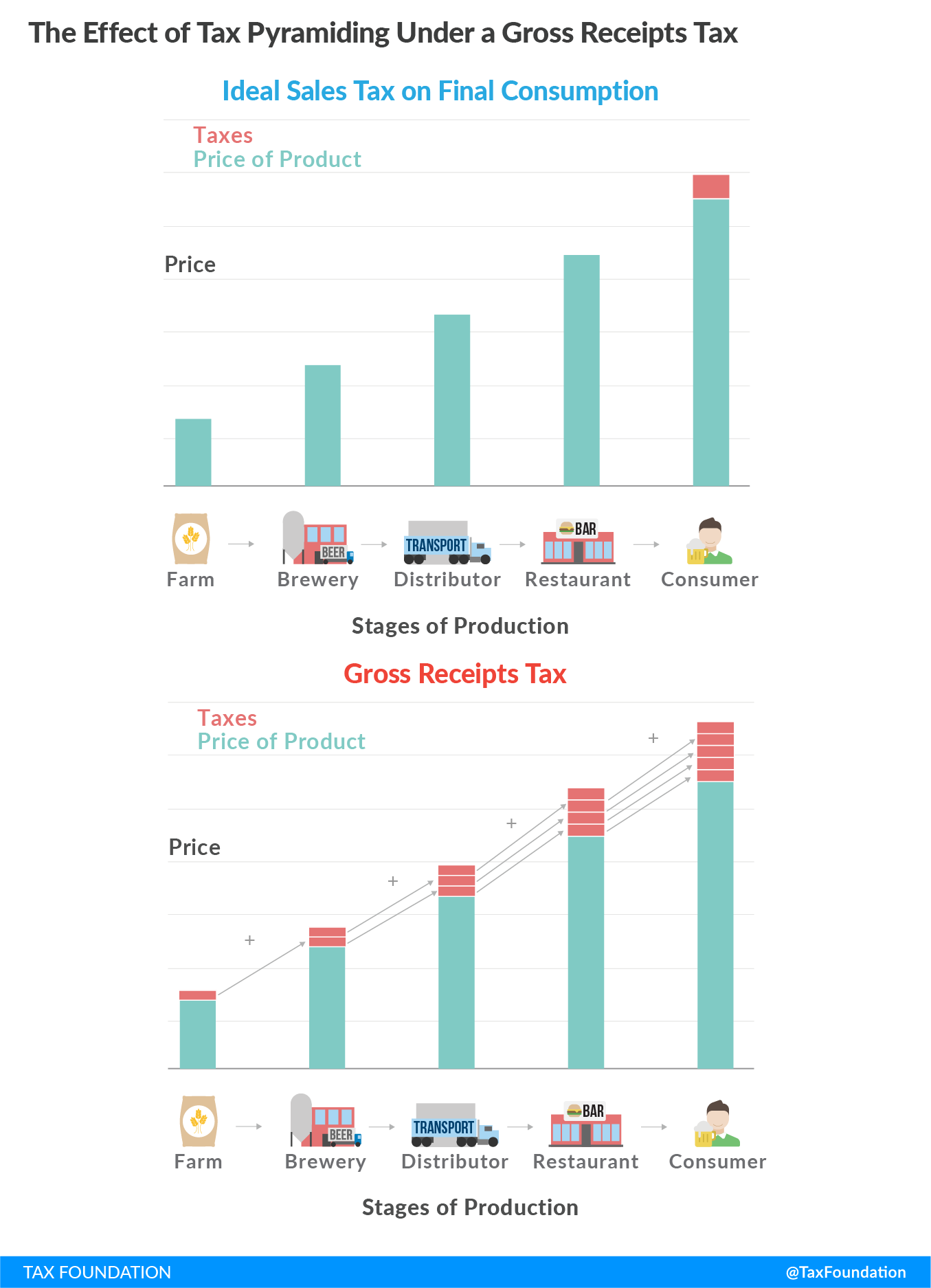

Gross Receipts Taxes An Assessment Of Their Costs And Consequences

State By State Guide Which States Have Gross Receipts Tax Taxvalet Sales Tax Done For You

San Francisco Gross Receipts Tax Clarification

State Gross Receipts Tax Rates 2021 Tax Foundation

State By State Guide Which States Have Gross Receipts Tax Taxvalet Sales Tax Done For You

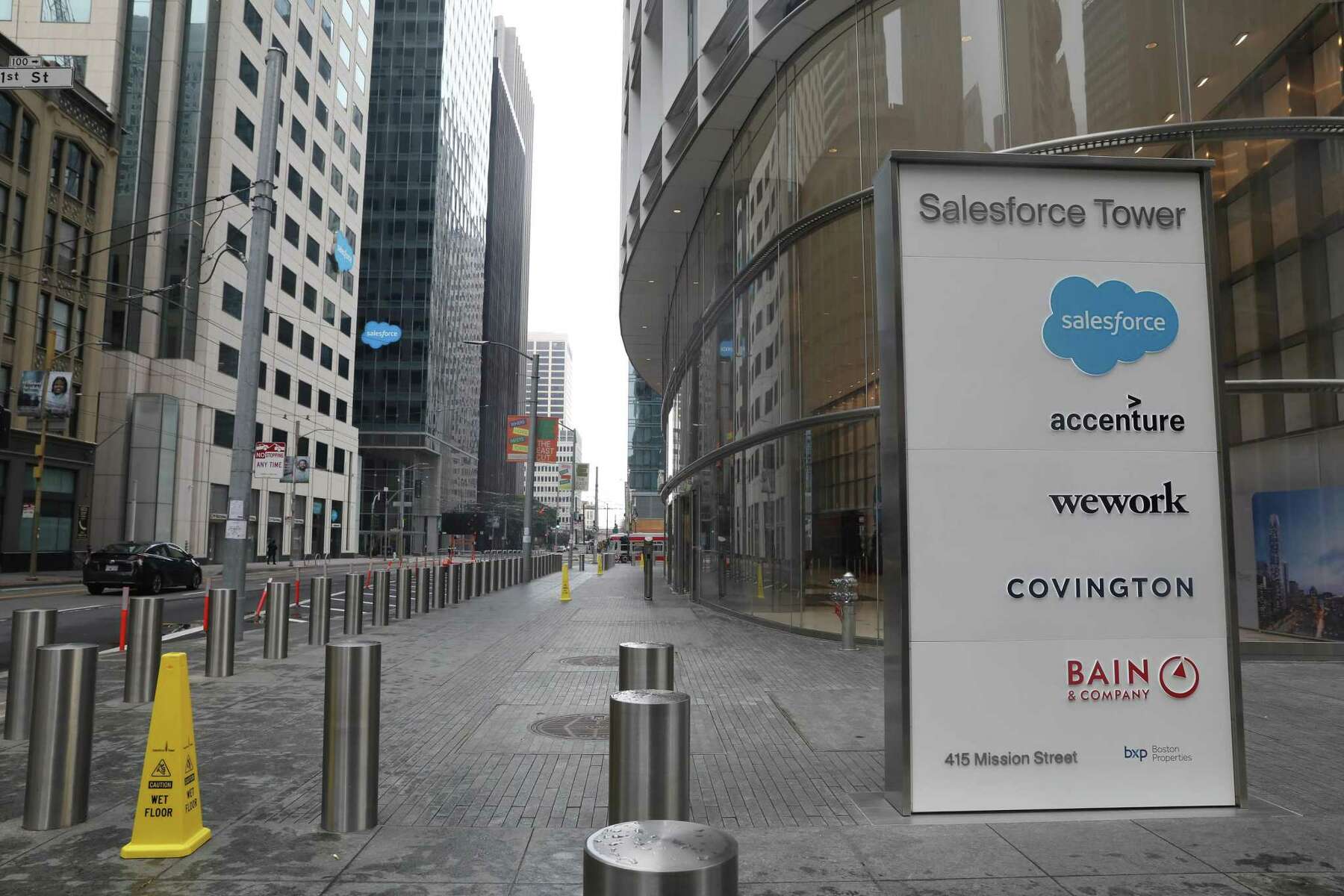

S F Businesses Will Find Remote And Hybrid Work Are Going To Be Taxing Matters

Oregon S Gross Receipts Tax Proposal Would Increase Consumer Prices Tax Foundation

State Tax Update The Shift From Cost Of Performance To Market Based Sourcing Marcum Llp Accountants And Advisors

State Local Tax Manager Resume Samples Velvet Jobs

Gross Receipts Tax Category Archives Seesalt Blog Published By State Local Tax Attorneys Pillsbury Winthrop Shaw Pittman Llp

Annual Business Tax Returns 2019 Treasurer Tax Collector

San Francisco Voters Approve Ballot Measures Overhauling City S Business Taxes And Imposing A New Overpaid Executive Gross Receipts Tax Deloitte Us

Uc Davis Summer Tax Institute Advanced Income Tax Track Ppt Download